Small Steps to Ease Financial Worries and Regain Control

As we juggle life, work, family, and all the other challenges that come with the current economic climate, it’s important to remember that we’re not alone. We’ve all been there—feeling the weight of financial stress and the pressure to keep everything afloat.

Starting Miss Money Savvy was our way of finding the best products and services to help ease that stress, and to share what we’ve learned in the hopes of making your financial journey a little bit smoother. Over the coming months, we’ll be introducing more tips and new services that we hope will streamline your life and support our growing community.

If you’re struggling right now, please know there are organisations that can help. You are not alone, and there is always a way forward. Everything can be sorted, and even small steps can make a big difference.

Here are a few ways you can start making changes today to help reduce stress and regain control:

Start with Small Changes

Big changes can feel overwhelming, but small steps are much more manageable. Begin by making one or two small adjustments to your routine, and gradually build from there.

Separate Your Accounts

Personally, I’ve always found it helpful to have multiple bank accounts. One for bills (like rent, mortgage, gas, electric, and phone), and another dedicated solely to savings. This separation helps keep things organised and makes it easier to track where your money is going.

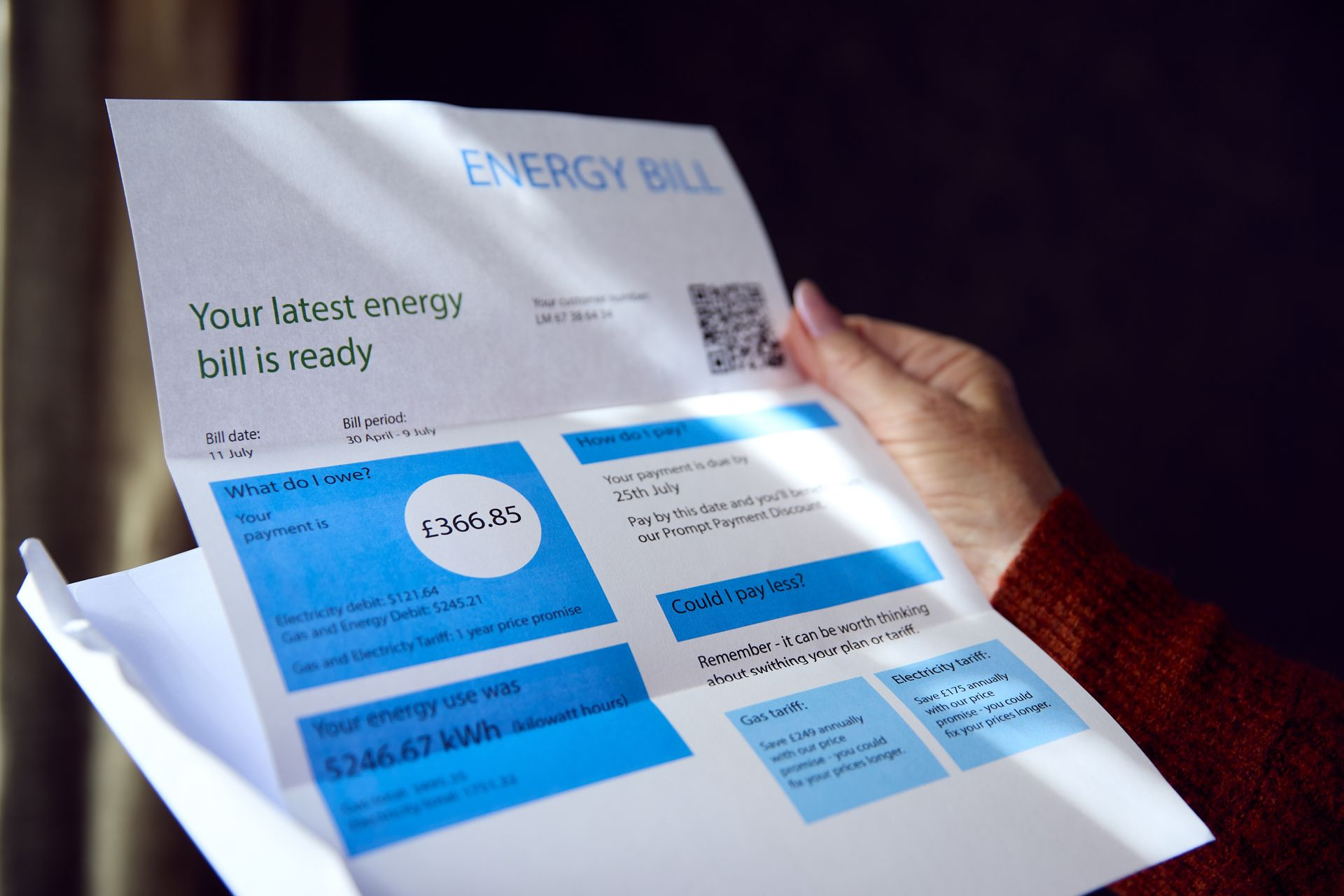

Make Sure You’re Getting the Best Deals on Household Bills

Take a moment to review your providers. You might be able to save money by switching to a better deal or simply calling to ask for a discount. It’s easy to overlook, but those savings can really add up over time!

Reduce Unnecessary Spending

It’s easy for small subscriptions to sneak up on you. Review your monthly payments—those extra streaming services or mobile phone add-ons—and cancel anything that isn’t essential. And don't forget about online shopping! Consider reducing the number of parcels you receive by cutting down on impulse purchases. Every little bit helps!

Speak to Someone

If you’re feeling overwhelmed, don’t hesitate to reach out—whether it’s a friend, a family member, or an organisation that specialises in financial support. You can contact the Citizens Advice service, Step Change and the Mental Health Charity Mind. Talking things through can make a huge difference in easing your mind and finding solutions.