Smart Meters: A Help or Hindrance?

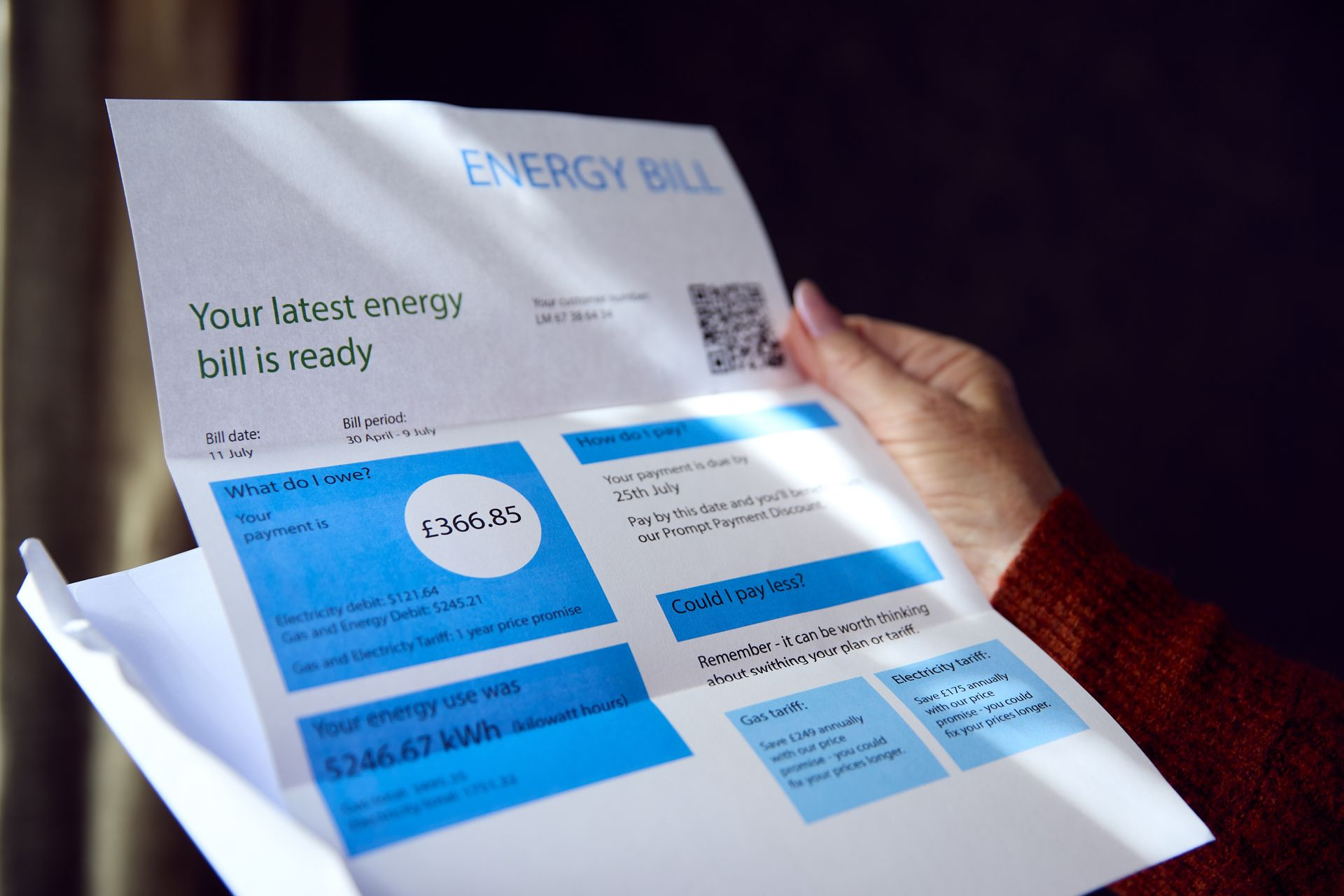

Some people think I’ve “moved over to the dark side” by switching to a smart meter, but with energy prices escalating, it’s actually been a game-changer for me. With a full house, it’s easy for others to overlook the costs of gas and electricity, but the smart meter helps me keep track of our household spend. It’s given me peace of mind, knowing I’m neither over nor under-paying. In these times of rising costs, it’s comforting to have that control over our energy usage.

That said, smart meters come with their own set of pros and cons. So, are they truly a benefit or a hindrance?

Benefits of Smart Meters:

- No More Estimates: Smart meters send accurate readings directly to your supplier, so you won’t get estimated bills.

- Real-Time Tracking: The in-home display shows exactly how much energy you’re using, helping you spot ways to cut back.

- Cost & Energy Control: Seeing your energy usage helps you make better decisions to reduce consumption and save money.

- Environmental Impact: By promoting energy efficiency, smart meters help reduce your carbon footprint.

- Better Tariffs: Which could lower your energy costs.

Downsides:

- Connectivity Issues: While older smart meters relied on mobile signals, newer models are much more reliable and work with a dedicated wireless network, ensuring better connectivity.

- Not Automatic Savings: A smart meter alone won’t lower your bills, it’s up to you to actively manage your energy usage.

- Over-monitoring: Some people may find themselves obsessing over every unit of energy used.

Conclusion:

Smart meters provide real-time insights into your energy use, ensuring accurate bills and offering control over household consumption. While they’re not a magic fix for lowering bills, they are a valuable tool for managing costs and reducing energy waste. For me, it’s all about staying in control during a time when every penny counts.