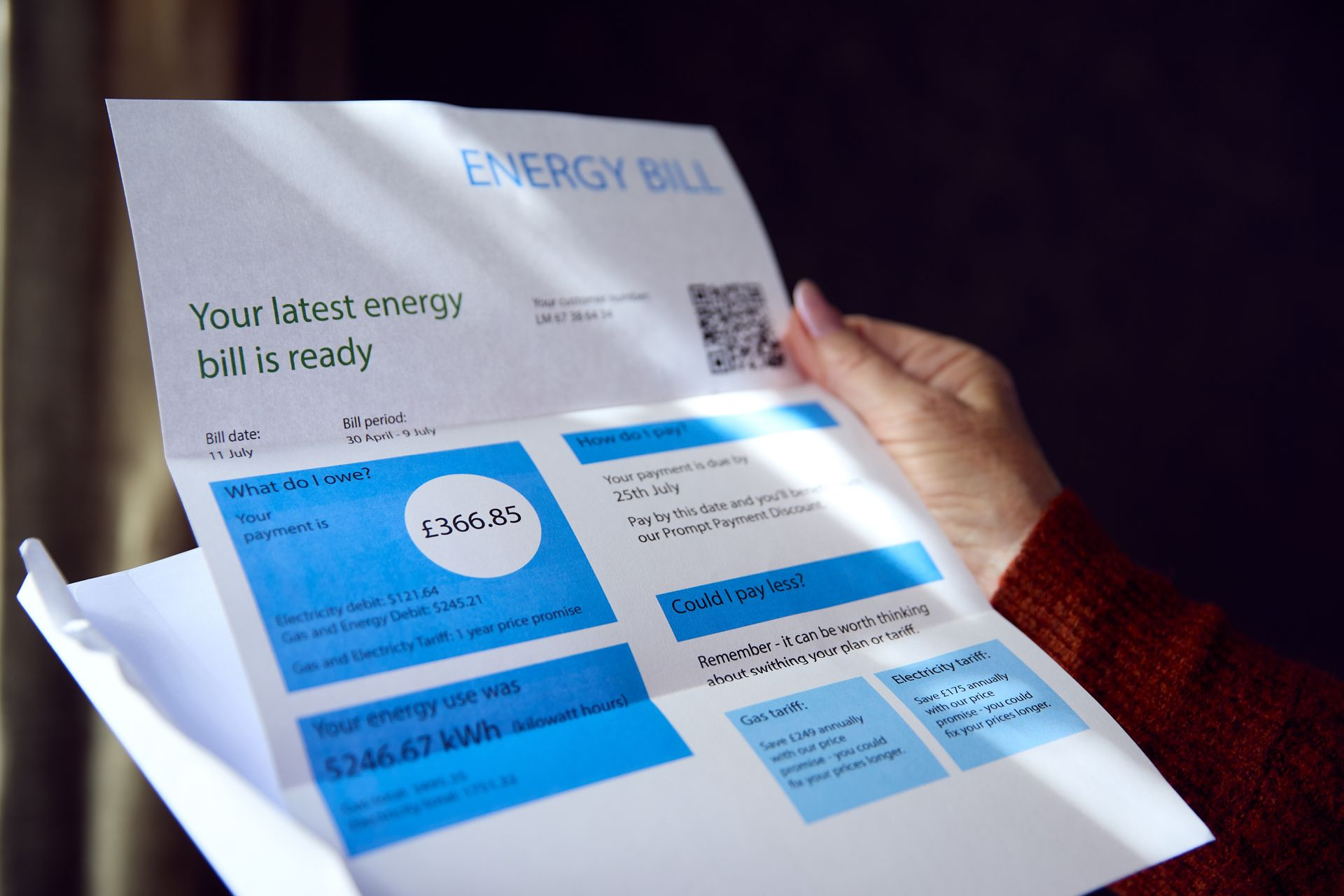

Don’t Let Your Energy Bills Take You by Surprise This Winter

The weather’s turning colder, and most of us know what that means - higher heating bills.

With prices changing again, many households across the UK will be watching their energy costs rise and wondering what to expect next.

At Miss Money Savvy, we like to keep things simple. Here’s what’s going on, what it means for you, and how a few smart choices could help you keep more money in your pocket this winter.

What’s Happening With Energy Prices?

The energy price cap is reviewed every three months. It limits what suppliers can charge for gas and electricity, but when wholesale costs change, so does the cap. That means your bills can go up or down, depending on what’s happening in the energy market.

Right now, the cap is set until the end of December, and the next update will come in January.

No one can say for sure which way it will move, but one thing’s certain - energy prices are unpredictable.

That’s why it’s a good time to check your current deal and see if you could save before the next change hits.

Fixed Deals Can Bring Peace of Mind

Like me, if you prefer to know exactly what you’ll be paying, a fixed-rate deal can help. This locks in your price for a set time, so your bills stay steady even if the market changes.

It’s not always the cheapest option for everyone, but it gives many people peace of mind, especially through the colder months when energy use is at its highest.

Bundle Up and Save More

At Miss Money Savvy, we don’t just compare energy, we bundle your gas, electric, broadband, and mobile to get you the best savings possible.

It might sound a bit unusual, but the savings speak for themselves:

As of September 2025, our customers are saving an average of £103 per month - that’s over £1,200 a year back in their pockets!

Here’s why it works:

· One simple monthly payment

· One invoice (no more juggling multiple bills!)

· Exclusive discounts for having everything under one roof

We do the hard work for you, finding the right deals and combining them in a way that gives our customers the biggest overall savings.

It’s all about making life simpler and smarter — the Miss Money Savvy way.

Take Control This Winter

We help households across the UK cut their costs and feel more in control of their money — from energy to broadband, mobile and more.

It’s quick, easy, and completely free to check.

Start your free household review today

Because staying warm this winter shouldn’t mean spending more than you need to.