What Do Interest Rate Cuts Really Mean?

The Bank of England has cut interest rates. But what does that actually mean for most of us?

In simple terms:

- Mortgage and loan payments might come down a little.

- Credit cards could be slightly easier to pay off.

- Savings in the bank will likely grow more slowly.

Good news if you’re borrowing, not so great if you’re saving.

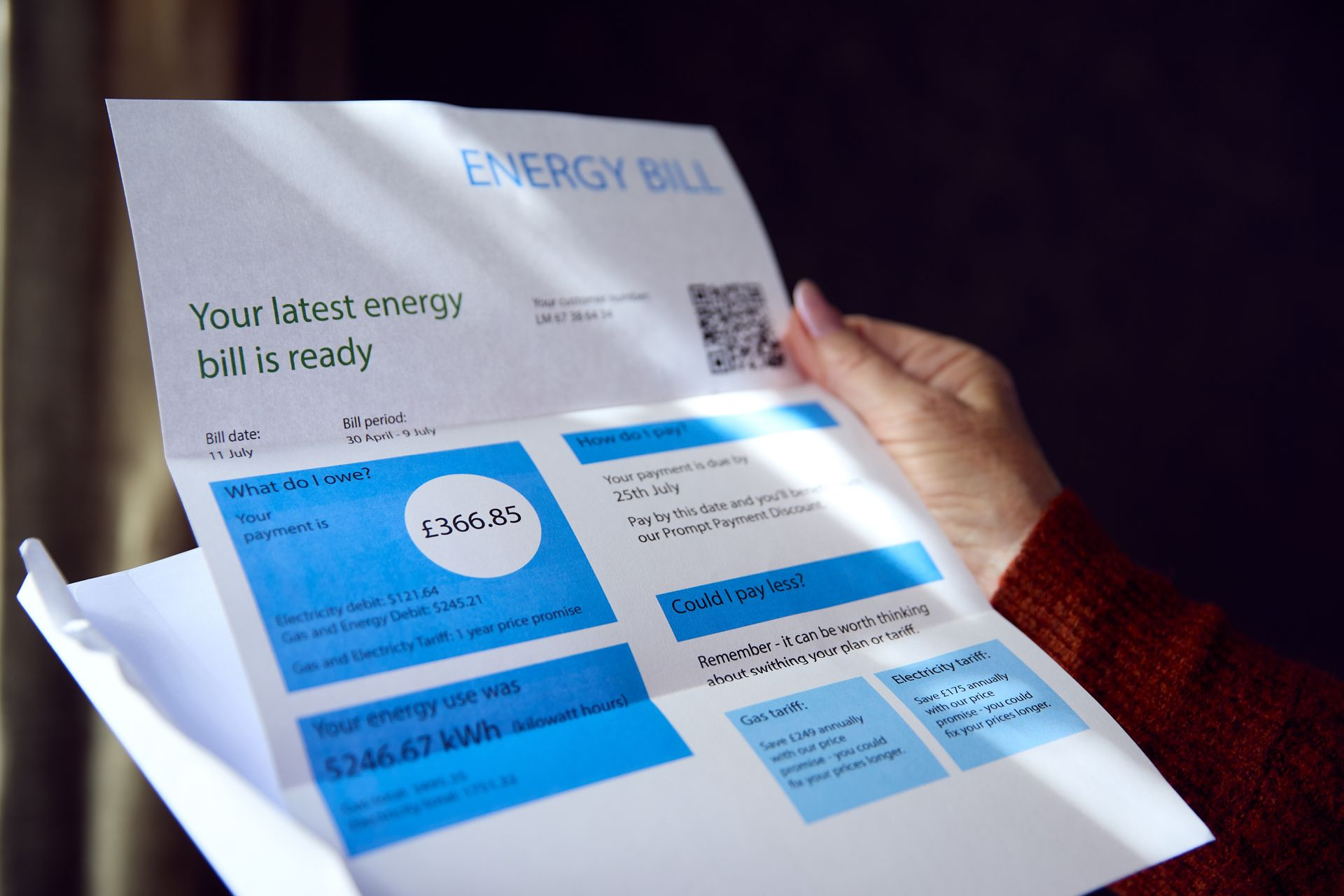

But here’s the reality - An interest rate cut doesn’t reduce the cost of living. Energy, broadband, mobiles, and insurance bills don’t get cheaper just because the Bank of England changes rates.

And that’s where the biggest savings are often hiding.

At Miss Money Savvy, we offer a free, no-obligation review of your household bills to see where you could save.

- 9 out of 10 people save when we carry out a review.

- The average saving is around £70 a month (figures as of 20th August 2025).

While interest rates go up and down, the one thing you can control is making sure you’re not overpaying on your everyday bills.

What’s Behind Miss Money Savvy?

We started Miss Money Savvy with one simple belief: people deserve to keep more of their hard-earned money. Too often, households end up paying more than they need to for everyday bills without realising it.

Our job is to shine a light on where savings can be made, in a way that’s clear, friendly, and pressure-free. If we can help you cut your bills, brilliant. If not, you’ll have peace of mind knowing you’re already on a good deal.

Because at the end of the day, it’s about making life a little easier and helping you feel more in control of your money.

Book your free, no-obligation Household Bills Review today Free Review - Household Bills or call 0161 505 0979 and one of our team will be able to help.