Your Savvy Winter Home Check & Prep Guide

Winter brings colder days, cosier nights — and a few extra things to keep an eye on around the home.

A little preparation now can make your winter easier, warmer and more efficient.

Here’s an easy checklist to help you feel ready without any fuss.

1. Know where your stop tap is:

It’s useful to know where your stop tap (or stop cock) is located — just in case you ever need to turn the water off quickly.

- Find it now, so you’re not searching later

- Make sure it turns properly

- Let others in the home know where it is too

2. Add simple insulation where you can

Pipes in colder spots like lofts, garages and outdoor areas can benefit from a bit of protection.

- Use inexpensive pipe lagging from a DIY store

- Pop an insulated cover on your outdoor tap

- Insulating hot water pipes can help reduce heat loss

If you’re renting, your landlord can help with insulation checks too.

3. Give your heating system a quick once-over

A quick check now keeps everything running smoothly when the cold weather hits.

- If your boiler hasn’t been serviced in a while, it might be worth booking one

- Bleed radiators that feel warm at the bottom but cool at the top

- Check boiler pressure and top up if needed

- If your boiler has a frost setting, make sure it’s switched on

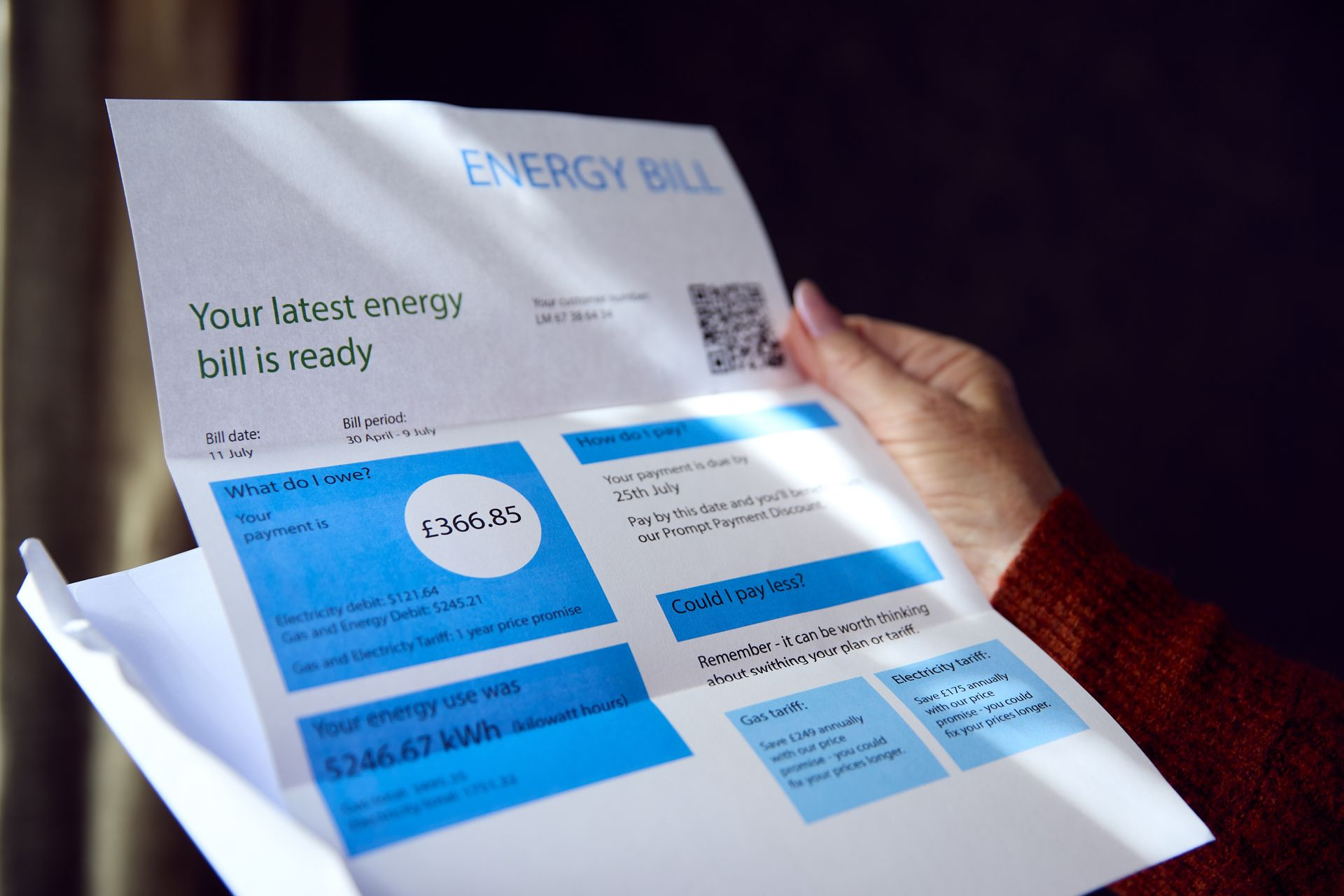

4. Keep your home cosy and energy-smart

A few simple habits can make your home feel warmer and help keep bills steady.

- Close curtains at dusk

- Use draft excluders on doors

- Check loft insulation if you have access

- Use thermostat timers to warm the home when you need it most

5. Heading away this winter?

If you’re not home for a few days or weeks, a tiny bit of planning gives peace of mind.

- Keep the heating on a low or frost setting

- Make sure pipes and tanks in colder areas are insulated

- Ask someone nearby to check the home if you’re away for longer periods

6. Useful extra tips

Small actions that make a big difference over winter:

- Disconnect garden hoses

- Keep gutters and outdoor drains clear

- Test smoke and carbon monoxide alarms

- Keep plumber/handyman contact details somewhere handy

A little preparation goes a long way

These steps are simple, low-stress and designed to make your winter more comfortable — without worry or big costs.

If you’d like help checking your energy, broadband or mobile to make sure you’re not overpaying this winter, our team can review that quickly and for free.