Why Do We Wait Until Crisis Hits Before We Cut Costs?

Are we all just creatures of habit… or something more?

Most people don’t start looking for savings when life is calm.

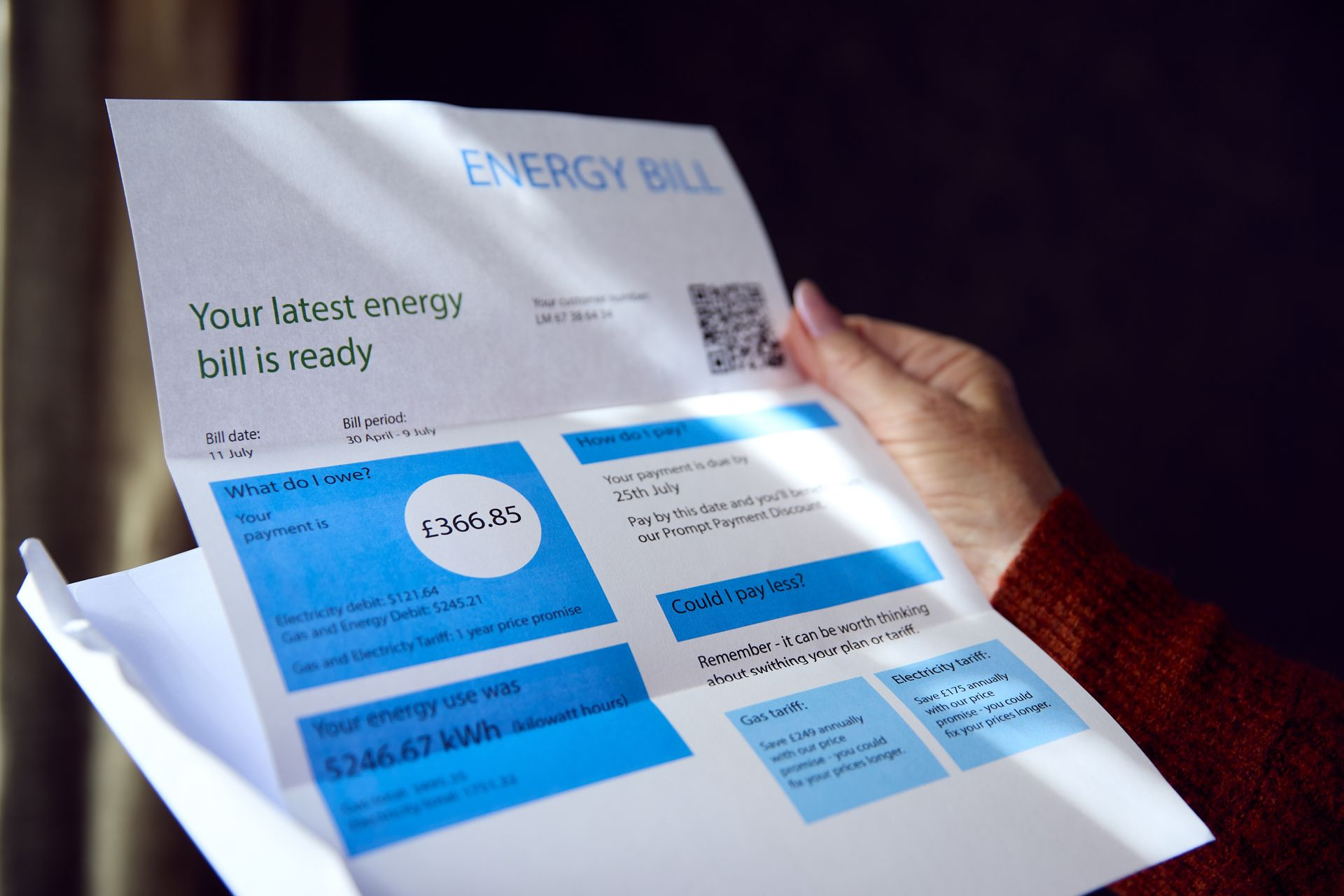

They wait until something forces their hand — a bill spike, a job change, a financial shock, or that sinking feeling when the bank balance doesn’t stretch as far as it used to.

But why do we behave like that?

1. Habit is powerful — and expensive

Humans are creatures of routine. If your broadband works, if the lights come on, if your mobile bill “seems about right”… you don’t question it. Even if you’re overspending every single month.

In the UK, millions of households stay on default tariffs, out-of-contract broadband, or rolling mobile deals simply because it’s what they’ve “always” had. And that habit quietly drains money month after month.

2. We underestimate the savings

People assume switching is complicated, time-consuming, or won’t make much difference. But it’s the little things — the “simple” bills — that often make the biggest impact. Broadband, mobile, insurance, energy bundles… these are the easiest wins. Yet they’re the last things we bother to check.

It’s not just laziness — it’s lack of awareness. If people truly understood the hundreds of pounds they could claw back, they’d do something sooner.

3. The UK is reactive, not proactive

We are phenomenal at coping when things go wrong. But forward planning? Not so much.

It’s why so many households don’t review their bills until a crisis. We wait for the pain rather than preventing it.

4. Stuck in a rut — and we don’t see a way out

People often say:

“I’ll sort it next week.”

“I’ll look at that bill later.”

“I’ll switch at some point.”

And then months pass.

We become numb to direct debits. They just slide out of the account, quietly eating away at our income. It’s not laziness — it’s overwhelm. Life is busy, money feels complicated, and the admin piles up.

5. The truth? Saving money doesn’t have to be painful

Most people aren’t avoiding savings because they don’t care — they’re avoiding it because they think it’s a hassle. But saving money today is easier than it has ever been.

You can review your energy, broadband and mobile in minutes. No fuss. No jargon. No pressure.

And the results?

Most UK households do save — often more than they expected.

A better question is: why not start now?

Why wait for the panic moment?

Why leave money on the table?

Why keep paying more than you need to?

Completing our quick Bills Review today could mean:

- More money in your pocket each month

- Less stress

- A stronger financial start to 2026

- And the knowledge that you’re taking control instead of being caught off-guard

Small actions today prevent big problems tomorrow. And the best part?

You don’t have to do it alone. Click Here To Save With Miss Money Savvy Today